Interview: Sherry Irwin on Vendor Lifecycle Management

Sherry Irwin, TAM Inc.

Sherry Irwin of Technology Asset Management Inc. will be sharing her views of Vendor Lifecycle Management at the IAITAM Annual Conference and Exhibition on the 13th October. Sherry has kindly shared an overview of her methodology.

ITAM Review Q: Please describe your perspective on Vendor Lifecycle Management – what does it entail?

My perspective on IT Vendor Management is ITAM-centric where ITAM is a business function and:

- Vendors (and contracts) are a means by which IT assets and services are provided.

- IT assets and services provide the business value – the end result.

- Vendor and asset lifecycles are highly interdependent, as is their management.

- Vendor management and ITAM have similar (overlapping) drivers, benefits and practices.

- Vendors, and their management, can be a strength or a weakness.

- Effective lifecycle vendor management is a pre-requisite to ITAM maturity.

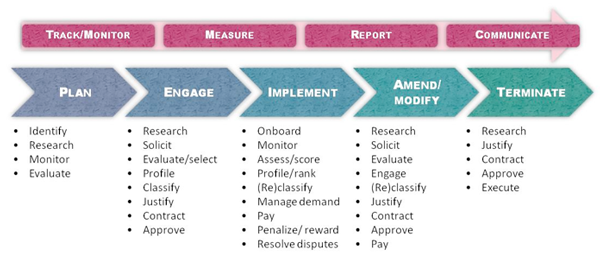

In that context, I define IT Vendor Management as standard lifecycle practices to:

- Communicate with

- Solicit from

- Engage (contract) with

- Monitor performance of

- Resolve conflicts with…

…suppliers of products and services, to ensure minimal cost, maximum value and acceptable risk to the organization.

Vendor Lifecycle and Accountabilities

A New Imperative

In the last 18 to 24 months, there has been an increasing trend for IT organizations to take (back) responsibility for some or all vendor (and contract) lifecycle activities and to (re)establish vendor (and contract) management programs Factors driving this trend include:

- Greater dependency on external providers (vendors) due to outsourcing, off shoring, software-as-a-service, cloud computing etc., with more, and more complex, vendor relationships.

- More people involved across organizational boundaries:

- Gaps and inconsistencies: process, data, tools, communication etc.

- Varied objectives, priorities

- Varied skills and knowledge

- Varied, inconsistent and compromised results

- Contracts and Vendors and not ‘managed’ post-procurement

- Orphan contracts/vendors

- Additional and/or greater costs and risks

- Compromised value

- Compromised leverage

Q. What best practices can you advise?

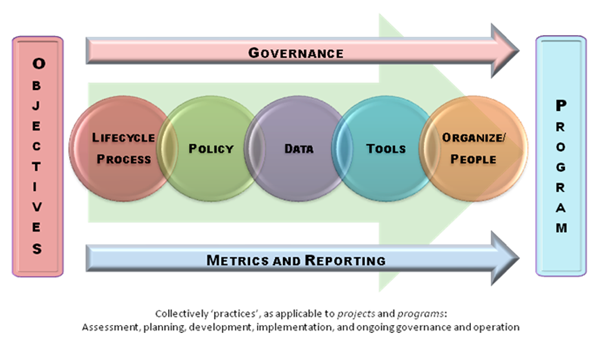

With reference to the Program Framework:

Organization:

- Central governance, with well-defined mandate, plan, accountabilities, and stakeholder commitment; also sufficient, capable and empowered staff.

- Well-defined (cross-organization) operational accountabilities.

- Education, training and awareness programs.

- Internal and external (industry) insight:

- Relevant industry trends, issues and practices.

- Vendors’ business practices, viability, market position, roadmap etc.

- Liaise with other customers, share knowledge, experience and results.

- Communicate successes and value.

Policy and Process:

- Forecast and plan for (new) vendor activity.

- Classify vendors based on standard criteria; manage appropriately based on classification – not all vendors need to be managed to same degree.

- “Managed communications”: Control information flow through defined policies and roles; operationalize with staff and vendors.

- Consolidate and leverage spend (by and amongst vendors).

- Analyze contract portfolios to identify inconsistencies, risks and opportunities: leverage and improve.

- Include vendors’ contracts and business practices in evaluation of solutions.

- Monitor performance/delivery against contract terms, expected value and industry.

- Verify invoices – more than a three-way match!

Data and Tools:

- Maintain a central repository of key data and interrelationships: vendors, contracts, financials etc.

- Retain and reference historical documentation – e.g. notice of change in company or product.

- Maintain and use supporting Vendor Management Toolkit – e.g., vendor scorecard, checklists.

Additionally:

- Know your vendor better than they know you: strengths, weaknesses; Internal/external experience.

- Maintain a competitive environment, with credible alternatives.

- Use vendors effectively as a resource (e.g., training).

- Have an exit strategy!

Program Framework

Q. What benefits should an organization realize as a result of this approach?

As a general principle, organizations need to look for ways to `raise the bar ‘with their vendor; otherwise, many will deliver to the lowest possible level. A strong and committed vendor will respond favourably to greater demands, provided they are reasonable, with additional direct and indirect benefits to the organization.

Benefits include, but are not limited to:

- Optimize spend: control costs, realize expected value

- Increase leverage

- ‘Managed’ communications: consistent, appropriate, effective

- Provide critical information for timely/accurate/informed analysis, reporting, decisions, action

- Increase compliance – by all parties

- Protect sensitive or confidential information

- Identify and mitigate risks

- Resolve conflicts quickly and effectively, with less impact

- Reduce administrative costs – do more with less

- Increase business flexibility

Q. What checklist or framework do you suggest for collating information on vendors?

As part of the Vendor Management Toolkit:

- Vendor Viability Checklist, for initial and periodic evaluations: solutions, financial, legal, support, etc.

- Vendor Performance Scorecards

- Vendor Classifications (based on defined criteria)

- Vendor Profiles (ideally captured in a vendor repository)

- Vendor Contracts: assess existing – individually and comparatively, as well as proposed

Q. How regularly should this data be updated?

It is not a question of frequency as much as it is opportunity or need – i.e., as vendor lifecycle events occur, relevant data should be updated – ideally by the person most closely involved in that event.

In terms of formal analysis and reporting, monthly or quarterly for Tier 1 vendors, semi-annually for Tier 2 and annually for Tier 3; rest based on need and resources. (As Tiers are defined by the organization.)

Q. Can you provide case studies or examples of this approach in action?

Case Study – Best Practice: Analyze (‘mine’) contract portfolios to identify inconsistencies, risks and opportunities: leverage and improve.

Approach:

- Identified ten material software and maintenance suppliers, including those with a history of acquiring other companies – e.g., Oracle, CA.

- Identified assessment criteria in three categories: contract terms (e.g., discounts); product usage/value; and supplier viability/performance.

- Assessed cross contract and individual contract opportunities against defined criteria.

- Developed and executed action plan in consultation with contract owners and supplier relationship manager.

Results:

- Reduced software expenditures in excess of $500K over 2 years.

- Identified software over licensing in excess of $1M in annual maintenance costs.

- Obtained higher discounts on software maintenance for a subset of a supplier’s products, based on discounts in effect for other products.

- Consolidated 15 individual contracts into three master agreements, providing consistent terms and simplified and reduced administration.

- Increased contract owners’ understanding of contract terms, and associated obligations and risks; existing supplier relationships (strengths/weaknesses/issues); and increased the level of collaboration and cooperation amongst business units and contract owners.

- A catalyst for implementation of consistent policies and processes for enterprise-wide and lifecycle vendor (and contract) management.

Sherry Irwin will be sharing her views of Vendor Lifecycle Management at the IAITAM Annual Conference and Exhibition on the 13th October.

Can’t find what you’re looking for?

More from ITAM News & Analysis

-

Flexera is first SAM tool vendor verified for Oracle E-Business Suite applications

Flexera has announced that it has been verified as the first software asset management (SAM) tool vendor for Oracle E-Business Suite applications. Almost anyone with an Oracle estate will be familiar with the company’s License Management ... -

ITAMantics - March 2024

Welcome to the March 2024 edition of ITAMantics, where George, Rich and Ryan discuss the month’s ITAM news. Up for discussion this month are. Listen to the full ITAMantics podcast above or queue it up from ... -

ITAM & AI, FinOps, Containers, ESG, security: The many ways in which ITAM has matured beyond its roots

ITAM, AI, FinOps, Containers, ESG, security… Back in January I wrote about my picks from the agenda for Wisdom NA 2024. Building up to the event I also interviewed Eva Louis about the intricacy of IT ...