Gartner MarketScope for the IT Asset Management Repository 2013

Gartner analyst Patricia Adams published a new ‘MarketScope’ for IT Asset Management Repositories last month.

View a reprint here.

In case my link sets off the Gartner intellectual property fire alarm (as it appears to have done in previous years) you can also view a reprint via this blog post from Jon Hall at BMC).

The analysis is split into two parts: an industry synopsis followed by a broad-brush overview of Gartner’s opinion on the key tools in the space.

As with previous reports, Patricia does an excellent job of portraying current market trends, well worth a read.

I wish I could say the same about the tools overview, the words ‘Palaeontology’ and ‘Nostalgia’ spring to mind.

Watching the Watchmen?

I have, for my sins, been blogging on this site since 2008. In that time Gartner have released two previous editions of this report that I remember so I thought it might be useful to track scores over time.

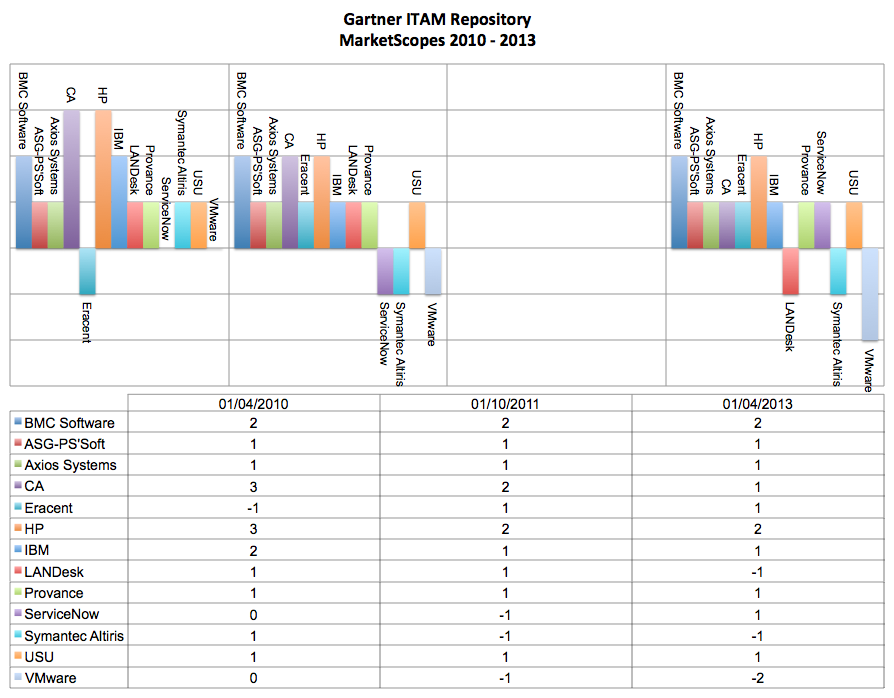

Gartner assign a score from ‘Strong Negative’ to ‘Strong Positive’ for each vendor. I’ve applied a crude numerical score against each of these rating as follows:

KEY

- Strong Negative (-2)

- Caution (-1)

- Promising (1)

- Positive (2)

- Strong Positive (3)

I’ve applied these numbers to the three last Marketscopes in the image below. Note that there was no report in 2012 and ServiceNow and VMware first entered in 2011 (hence zeros). Click on the image to enlarge it.

Observations

From 2011 to 2013 only ServiceNow improved. The rest either held their ground or got worse.

Aggregate scores for all tools each year are contracting. 2010 = 15, 2011 = 10, 2013 = 8. So perhaps either a) tools are getting worse or b) the assessment criteria are improving. Jon Hall (BMC) argues that this is because ‘the bar is being raised’. I would argue it is because the big G is tracking the wrong tools and / or the wrong market.

Gartner are hinting at this in the market synopsis:

“IT asset management tools are continuing to show modest growth, although the pressure from software license entitlement tools is taking away revenue”

Patricia Adams April 2013

As I mentioned after attending the Gartner EMEA conference back in October:

“Disconnect in ITAM Tools Coverage: I felt there was a bit of a disconnect in Gartner tool coverage. 90% of the content from the summit and exhibitors were focussed on SAM, yet Patricia Adams provided a 90′s view of Asset Repositories. She referred to SAM tools as an ‘emerging’ category which I felt was a bit of an insult to the tools and partners in the exhibitors hall and not an accurate reflection of the market. Gartner have no SAM tool analysis on the horizon and when asked, Patricia Adams stated some Gartner company spiel about category size. Big enough a category for two international conferences but not for tool analysis? An opportunity missed.”

My fear is that Gartner will, based on these spiralling scores, withdrawal their ‘MarketScope’ citing insufficient interest which would be inaccurate and send the wrong signals to the market. You could argue they did they same by taking their eye off the ball with the withdrawal of ITSM tools and subsequent ‘lipstick on a pig’ ITSSM rehash.

I also believe it is a case of misguided marketing. This is flagship promotional marketing content for Gartner which is sending the message they focus on big ole Asset Repositories when the focus of their events, clients enquiries and research focus on audit defence, contract negotiation and licensing.

As far as I can tell the Big G is the only analyst firm producing any decent content in this area (Forrester were threatening a SAM tools wave but just lost their talent to ServiceNow). They have the ear of large corporates making decisions and have a duty of care to inform their audience of what the broad market is doing rather than providing a ‘Big4 watch’. They are missing the most exciting and innovative part of the market.

(For a piercingly accurate view of mid-market innovation versus conglomerates stagnating I strongly recommend reading this article.)

View a reprint of the 2013 MarketScope here.

What do you think?

Can’t find what you’re looking for?

More from ITAM News & Analysis

-

Software Vendor Insights: What do the numbers tell us about the opportunities for ITAM negotiations?

What software vendor insights can be gained from the latest financial results from Amazon, Google, Broadcom, Salesforce, IBM and SAP? An important part of ITAM is paying close attention to the health of the companies we ... -

Flexera is first SAM tool vendor verified for Oracle E-Business Suite applications

Flexera has announced that it has been verified as the first software asset management (SAM) tool vendor for Oracle E-Business Suite applications. Almost anyone with an Oracle estate will be familiar with the company’s License Management ... -

ITAMantics - March 2024

Welcome to the March 2024 edition of ITAMantics, where George, Rich and Ryan discuss the month’s ITAM news. Up for discussion this month are. Listen to the full ITAMantics podcast above or queue it up from ...