Weak growth in SAM tools market - are SAM Managed Services to blame?

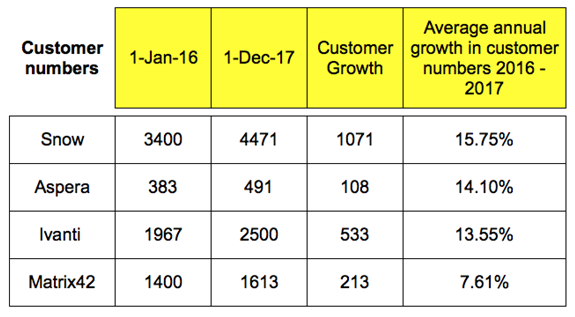

I recently polled some of the leading SAM tool vendors for their customer numbers.

I was keen to understand how much the market had grown since we last asked them in the SAM Tools Universe report back in 2016.

The SAM tools market is growing, but not as much as you would think.

Total customers on maintenance for Snow Software, Aspera, Ivanti and Matrix42 only grew by an average of 12.75% in the last two years.

Snow Software revenue is said to be growing at much faster rate than their customer numbers suggest. Which means they are either acquiring customers, but not keeping hold of them, or making more revenue per customer. Snow claim they are selling more to existing customers with significantly larger deal size.

Could the increase in SAM managed services be to blame for this relatively weak growth in customer numbers? We commonly see dissatisfaction with SAM tools, customers cite they are labour intensive despite being “automated”, and many SAM tools are yet to provide a holistic solution to management of cloud.

In contrast, talk with most SAM Managed Services providers and they claim to “work with any data source” to deliver an outcome, typically not caring whether the customer has a SAM tool or not.

What is your view? Is 12.75% growth across the top four SAM tool manufacturers what you expected? What do you think is to blame for relatively weak growth? Or is 12.75% a healthy growth rate for these top four suppliers? Please share your opinions in the comments.

Additional notes:

- Axios, making a bit more noise in the ITAM market, claim they have 73 ‘ITOM’ customers

- Brainware, Certero, Cherwell or Flexera did not respond.

- HPE (1,260 customers in 2016) declined to comment. We’ve heard SAM is no longer a focus area, I imagine it’s difficult to take HPE SAM seriously now they are owned by one of the world’s most aggressive auditors, Microfocus, whose shares recently halved in value following weak sales.

- ServiceNow stated they weren’t prepared to share customer numbers for specific product lines

- 1E, who seem to have retracted from the SAM market, have 77 customers, up from 75 in 2016.

Can’t find what you’re looking for?

More from ITAM News & Analysis

-

ITAMantics - April 2024

Welcome to the April 2024 edition of ITAMantics, our monthly news podcast where we discuss the biggest ITAM stories from the last month. George is joined this month by AJ Witt and Ryan Stefani. Stories tackled ... -

Broadcom is removing expired VMware licences from its portal - take action now!

Hot on the heels of Broadcom’s announcement of the end of perpetual licences for VMware it has given customers barely a week to download any keys for licenses from its portal with expired support. This is ... -

Who Loses When Broadcom Wins?

News of a new Broadcom deal rarely arrives with great fanfare. The November 2023 VMware acquisition provoked open worry online and in business circles, with many critics wondering whether the former Hewlett-Packard spinoff’s reputation would prove ...