Microsoft and Oracle = Frenemies, Flexera's RISCy business, plus Salesforce & Google want a piece of the BI

Microsoft and Oracle make friends?

Splinter and Shredder. Odysseus and Poseidon. Roy Keane and Patrick Vieira. There are some people you just wouldn’t expect to see on the same team.

When it comes to the world of software, Microsoft and Oracle are definitely on that list. Two behemoths of the industry, with competing database products and now both in the cloud game – they have long been rivals and will always continue to be.

So you can imagine my surprise when, like software versions of Godzilla and Mothra, Microsoft and Oracle announced a “cloud interoperability partnership” which will enable “customers to migrate and run mission-critical enterprise workloads across Microsoft Azure and Oracle Cloud”. I instantly added it to my “News that shook the ITAM world” presentation that I was delivering at our Wisdom UK conference!

What’s it all about?

New capabilities announced include:

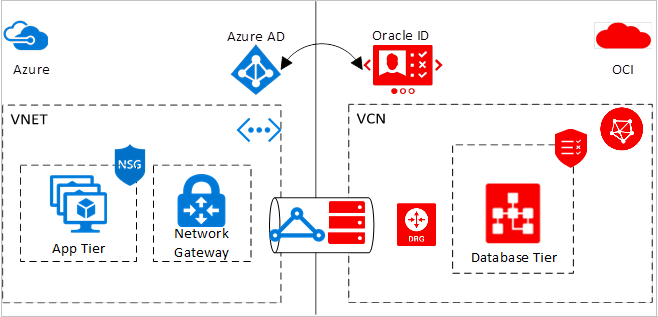

Connecting the two clouds: The primary aim is enabling the extension of on-premises datacentres into both Microsoft Azure and Oracle Cloud. Using Microsoft ExpressRoute and Oracle FastConnect, this is initially available in the Ashburn (Oracle) and Azure US East (Microsoft) datacentres, with plans to expand in the future.

Unified Single Sign-On (SSO): A unified sign-on experience and automated user provisioning across both cloud environments. In “early preview” there is also the ability for Oracle applications to use Azure Active Directory for identity and conditional access.

Cross-cloud support: Deploying Oracle apps including:

• JD Edwards EnterpriseOne

• E-Business Suite

• PeopleSoft

• Oracle Retail

• Hyperion

on Azure, whilst the databases:

• RAC

• Exadata

• Autonomous Database

Are deployed in Oracle Cloud.

High level overview of the connected solution, from https://docs.microsoft.com/en-us/azure/virtual-machines/workloads/oracle/oracle-oci-overview

Collaborative Support: Oracle and Microsoft will work together around customer support, enabling existing Oracle or Microsoft support channels to be used.

Microsoft EVP of Cloud & AI, Scott Guthrie, said this partnership “is a natural choice for [Microsoft] as we help our joint customers accelerate the migration of enterprise applications and databases to the public cloud” but did also mention that Azure is “the cloud of choice for the enterprise”. Oracle’s EVP of Cloud Infrastructure, Don Johnson (not the Miami Vice star!), said it means their joint customers “can migrate their entire set of existing applications to the cloud without having to re-architect anything”

Flexera’s latest acquisition

On June 4th 2019, Flexera announced the acquisition of RISC Networks.

Who are RISC Networks?

Founded in 2007 and headquartered in Asheville, North Carolina, RISC Networks have a product set that covers:

• Discovery & Dependency mapping

• Cloud Sizing & Pricing

• Cloud Migrations

• Environment & Device trends

• Security and IT threats

Jim Ryan, CEO of Flexera, sees this as a way for Flexera to help organisations “assess, prioritise and price which on-premise[s] workloads they should migrate to the cloud”.

RISC’s two primary products – Foundation, and CloudScape – helps discover assets, organise them into business assets, and model the costs for migrating them into the cloud.

Foundation provides agentless discovery, comprehensive inventory, intelligent application and services mapping, and application performance analysis. These features together enable an organisation to see who owns business services and the total cost of an application. CloudScape offers IaaS Price modelling, Datacentre/Cloud workload sizing, and product lifecycle reporting, giving the ability to map, and cost, the required infrastructure in the cloud.

These new additions, combined with the existing Flexera capabilities – recently enhanced with the MetaSaaS and RightScale acquisitions – give Flexera a very strong portfolio when it comes to datacentre discovery, application migration, and cloud management.

Salesforce buy Tableau

Salesforce, the “#1 CRM platform”, have announced they’re buying Tableau software for $15.7 billion in an all-stock deal. The deal represents them paying around a 45% premium for Tableau and is Salesforce’s biggest acquisition, dwarfing their 2018 purchase of Mulesoft for $6.5 billion.

Tableau?

Tableau, founded in 2003, have long been one of the big players in the Business Intelligence (BI) space. I’ve always viewed them as a more modern version of Crystal Reports and partly the reason that Microsoft first created Power BI in 2015 and have subsequently put so much effort into it as a product. Tableau are considered by many to be #1 in the BI space, although the latest Gartner Magic Quadrant actually shows Microsoft in the top right position:

You can also see that Salesforce, while far behind on “ability to execute” are actually further to the right than Tableau for “completeness of vision”; combining the two will put Salesforce a clear #2 and significantly closer to Microsoft. Gartner also mention that Tableau recently introduced a new subscription-only license, which certainly plays to Salesforce’s strengths.

Salesforce shares fell 5%, while Tableau shares rose 35% in pre-market trading after the deal was announced, with one analyst suggesting this may show fears that Salesforce is “buying growth because organic growth is slowing”.

Google acquire Looker

In related news, Google have announced their intention to acquire Looker – “a unified platform for business intelligence, data applications, and embedded analytics” – for $2.6 billion. You can see in the Gartner Magic Quadrant that Looker are in the bottom left quadrant while Google aren’t featured at all. Once closed, the new part of the company will join Google Cloud.

This puts Microsoft, Salesforce, and Google in close competition in the BI and analytics space. One wonders if Amazon are on the lookout too…perhaps Qlik or ThoughtSpot – the other two in the top right quadrant.

Further Reading

Microsoft & Oracle make friends?

Microsoft press release – https://news.microsoft.com/2019/06/05/microsoft-and-oracle-to-interconnect-microsoft-azure-and-oracle-cloud/

Microsoft site – https://azure.microsoft.com/en-us/solutions/oracle/

Oracle site – https://www.oracle.com/cloud/oci-azure.html

Flexera’s latest acquisition

RISC website – https://www.riscnetworks.com/products/

Salesforce buy Tableau

Press release – https://www.prnewswire.com/news-releases/salesforce-signs-definitive-agreement-to-acquire-tableau-300864394.html

Geekwire article – https://www.geekwire.com/2019/salesforce-buy-tableau-15-7b-betting-business-data-deal-seattle-tech-mainstay/

CNBC article – https://www.cnbc.com/2019/06/10/salesforce-to-buy-tableau-software-in-an-all-stock-deal.html

Google acquires Looker

Google announcement – https://cloud.google.com/blog/topics/inside-google-cloud/expanding-our-platform-for-business-intelligence-and-embedded-analytics

Can’t find what you’re looking for?

More from ITAM News & Analysis

-

Software Vendor Insights: What do the numbers tell us about the opportunities for ITAM negotiations?

What software vendor insights can be gained from the latest financial results from Amazon, Google, Broadcom, Salesforce, IBM and SAP? An important part of ITAM is paying close attention to the health of the companies we ... -

Flexera is first SAM tool vendor verified for Oracle E-Business Suite applications

Flexera has announced that it has been verified as the first software asset management (SAM) tool vendor for Oracle E-Business Suite applications. Almost anyone with an Oracle estate will be familiar with the company’s License Management ... -

ITAMantics - March 2024

Welcome to the March 2024 edition of ITAMantics, where George, Rich and Ryan discuss the month’s ITAM news. Up for discussion this month are. Listen to the full ITAMantics podcast above or queue it up from ...