Salesforce License Optimisation - Market Guide

Our latest Market Guide looks at options for Salesforce License Optimisation . It seems like only yesterday, but Salesforce is 20 years old this year. 20 years ago they set out on a mission to be a huge disruptor of the application software industry and it is safe to say that they have succeeded. They created a whole new way of buying services (that just happened to be delivered by software), were consistently ahead of the commercial use of the internet wave, and have built a $10bn business.

. It seems like only yesterday, but Salesforce is 20 years old this year. 20 years ago they set out on a mission to be a huge disruptor of the application software industry and it is safe to say that they have succeeded. They created a whole new way of buying services (that just happened to be delivered by software), were consistently ahead of the commercial use of the internet wave, and have built a $10bn business.

The Salesforce Business Model

This mission has resulted in a business model that has delivered massive innovation and growth in provision of software as a service, delivered over the internet. Established players were often slow to react – Office 365 didn’t arrive until 2011 – and so Salesforce had first mover advantage. In some ways they even pioneered the idea of the App Store with first AppExchange in 2005 and then Force.com in 2008. Their go-to-market approach is largely responsible for Shadow IT as a concept – they targeted the end users of the application, not IT & Procurement. Many a Salesforce relationship has started on someone’s monthly credit card bill. For commercial software startups SaaS is now the only way to go – low startup costs, rapid service iteration, and regular monthly income.

Delivering value?

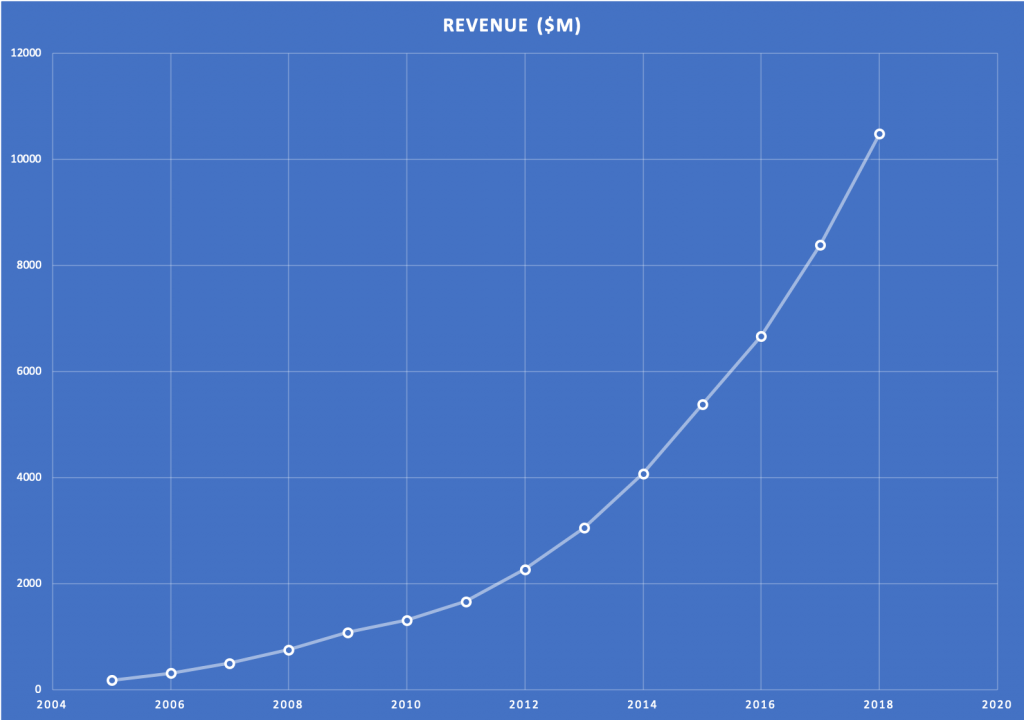

In the last few years Salesforece’s revenue growth has accelerated and shows no signs of slowing down – in part due to new agreement structures and licensing models. The lowest growth they published was in 2010 at the height on the recession – but it was stil 21%. They’re targeting double-digit percentage revenue growth year-on-year. As an ITAM Manager, this should prompt the question “Are we getting value out of our investment in this software?”

This month’s Market Guide to Salesforce License Optimisation provides you with a number of potential tools to help you answer that question and perhaps do your bit to put the brakes on that revenue growth. As with all our Market Guides, this guide is based on original research by ITAM Review analysts and attempts to provide an overview of the market. Vendors did not pay for inclusion in the guide – if you have a Salesforce subscription management tool you’d like to be included please contact me and I’ll be happy to include it in a future version. Similarly, if you have experience of using these tools, please consider submitting a review on our Market Place.

Can’t find what you’re looking for?

More from ITAM News & Analysis

-

Broadcom is removing expired VMware licences from its portal - take action now!

Hot on the heels of Broadcom’s announcement of the end of perpetual licences for VMware it has given customers barely a week to download any keys for licenses from its portal with expired support. This is ... -

Who Loses When Broadcom Wins?

News of a new Broadcom deal rarely arrives with great fanfare. The November 2023 VMware acquisition provoked open worry online and in business circles, with many critics wondering whether the former Hewlett-Packard spinoff’s reputation would prove ... -

Software Vendor Insights: What do the numbers tell us about the opportunities for ITAM negotiations?

What software vendor insights can be gained from the latest financial results from Amazon, Google, Broadcom, Salesforce, IBM and SAP? An important part of ITAM is paying close attention to the health of the companies we ...